The EURUSD currency pair is attempting to rebound from the lower limit of the downtrend. The growth of the dollar index against most major currencies put pressure on the euro. It is partially due to the stability of the U.S. economy under the conditions of tightening monetary policy.

According to U.S. Treasury Secretary Janet Yellen, the country will be able to curb inflation without any significant damage done to the labor market. This is evidenced by the data on a steady slowdown in price growth and an increase in employment.

Recent data shows that the rate of overall inflation in the U.S. has slowed down to near 3%. This exceeds the Fed's 2% target, but there has been no decline in wages or GDP.

Amid these and other data indicating steady growth in consumer spending and signs of stabilization in the real estate market, economists are easing their recession forecasts. Goldman Sachs Group Inc. experts now estimate the probability of an economic downturn in the U.S. at only 15%.

However, record bets on a stronger dollar are now indicating a trend reversal. All this takes place before the ECB key rate meeting this Thursday. Investor expectations of a pause in the rate hike cycle are now estimated at 60%. The likelihood of the pause has increased amid concerns about deteriorating economic growth prospects. At the same time, inflation remains stubbornly high.

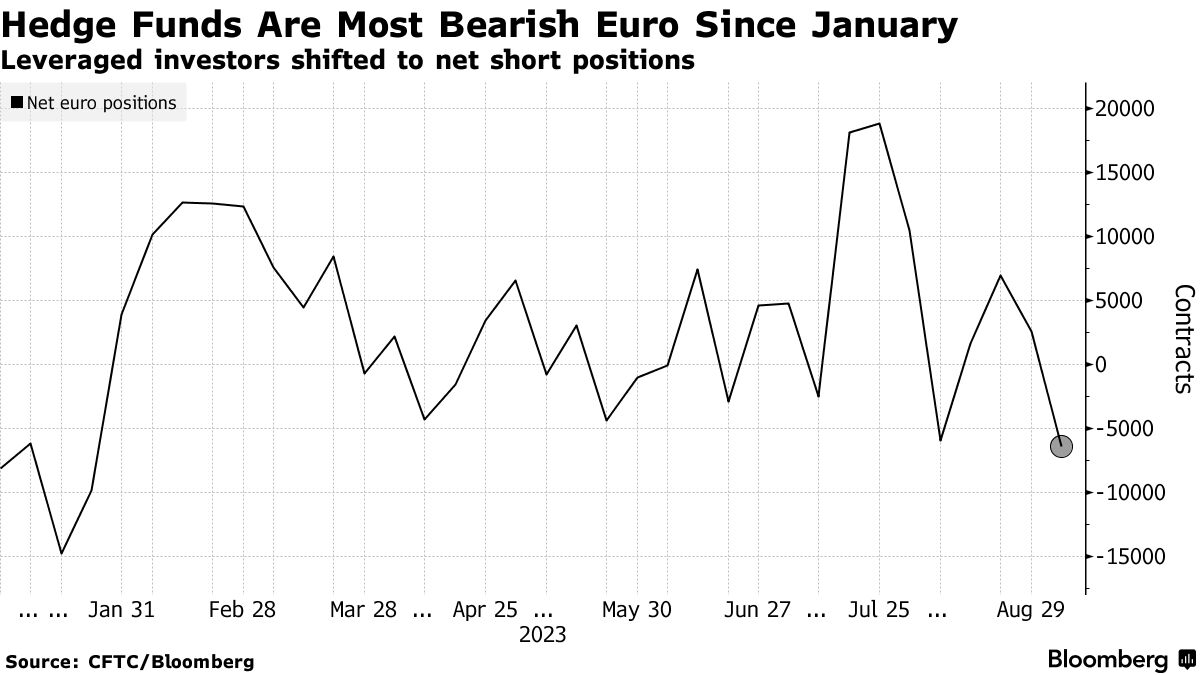

Traders held a net short position of 6,421 contracts last week, according to the latest data from the Commodity Futures Trading Commission. This represents the most bearish bet against the euro since January. Long-term asset managers also reduced their net long positions.

Based on technical analysis, EURUSD continues to move within the downtrend. However, the movement to its upper limit is now possible. This may happen due to the overbought dollar index and closure of record short positions in the euro.

The growth target will be the upper limit of the trend and the first Fibonacci retracement level of 0.236. It corresponds to the price of 1.082. A Stop-loss will be set when the local low at 1.067 is updated.

The EURUSD currency pair is likely to rise:

Take profit – 1.082

Stop-loss – 1.067

This content is for informational purposes only and is not intended to be investing advice.