Source: Bloomberg

Author: Devika Krishna Kumar

Article: Original article

Publication date: Wednesday, November 23, 2022

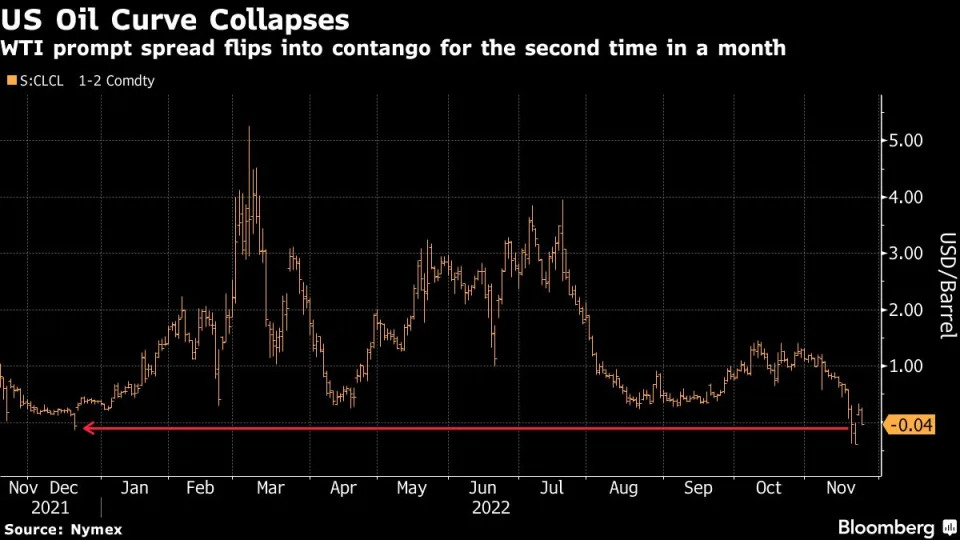

The key oil indicator again highlighted an oversupply signal despite a decline in U.S. crude inventories.

The U.S. crude oil futures curve moved into a bearish market pattern, known as a contango, for the second time this month. Traders ignored a bullish government report showing that inventories in storage had fallen to a two-month low.

The difference between oil prices of the current and the next contract

Despite European sanctions, which took effect in December, expectations that Russian oil will keep on flowing as well as weakening demand in China encourage traders to exit bullish positions ahead of the U.S. holiday.

The same thing occurred last week, when the fast U.S. oil spread turned contango for the first time in a year.

Forecast:

The sale of oil

This content is for informational purposes only and is not intended to be investing advice.